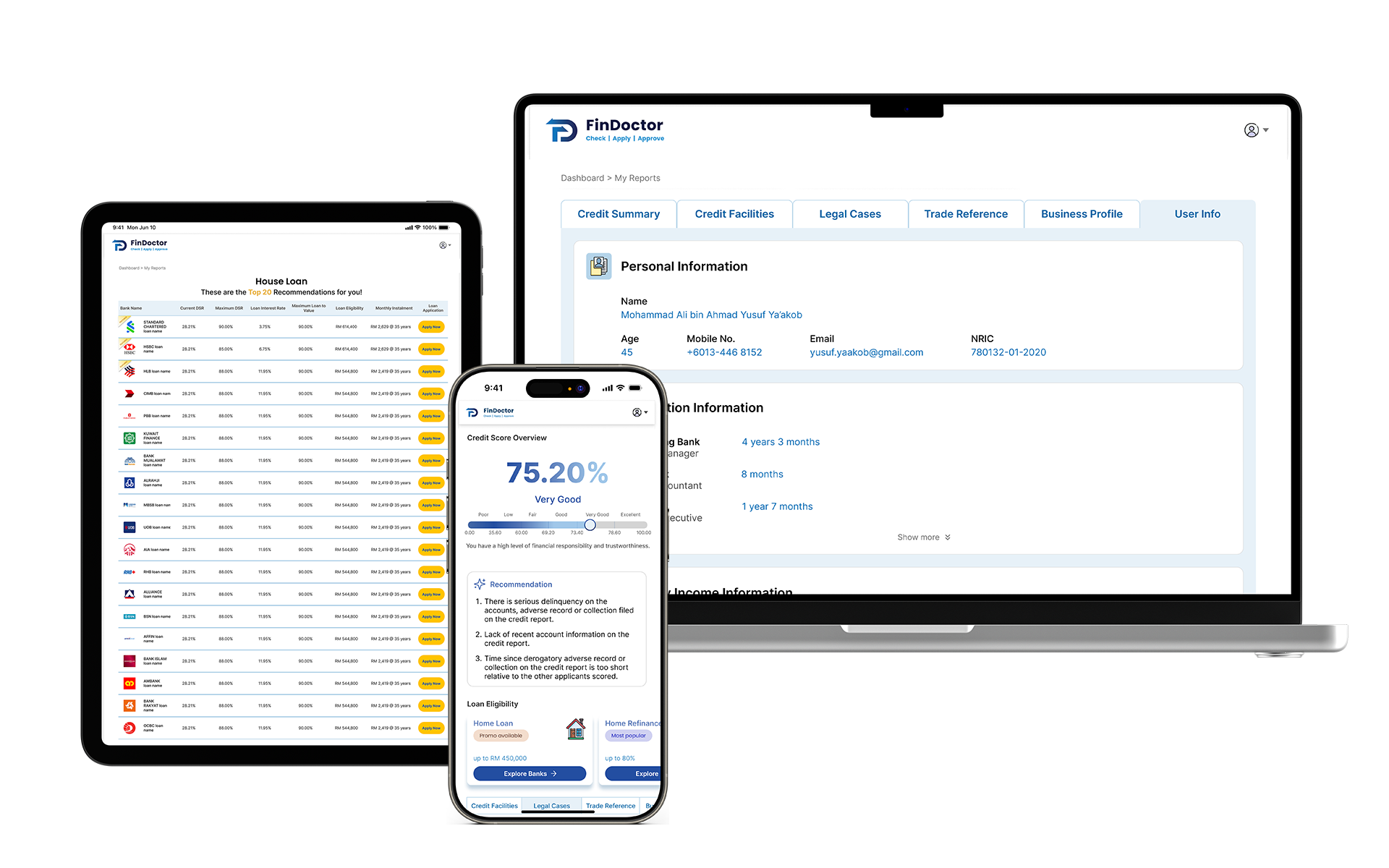

Your credit solutions in one spot

Home loan

Home refinance

Commercial loan

Commercial refinance

Personal loan

Why choose Financial Doctor?

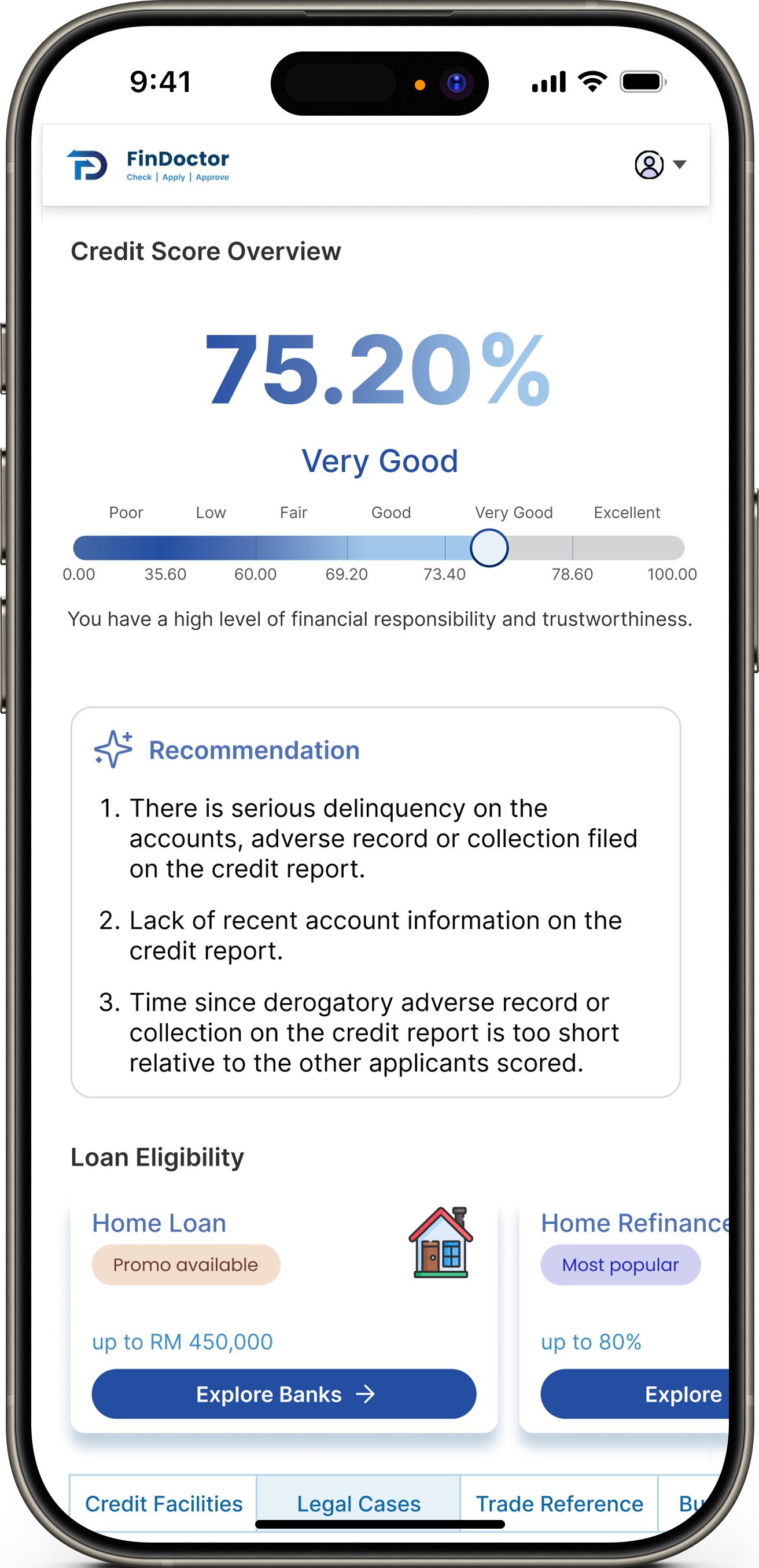

Credit insights

Understand your creditworthiness across 20 banks in Malaysia.

Tailored guidance

Access tailored personalised advice with Premium Application Service.

Credit repair

Correct errors, improve credit score for success.

Enhanced approvals

Getting higher loan approval rates after Premium Application Service.

Get consultation

How does FinDoc work?

1

Sign up for a new account

Let us know your personal details and information.

2

Upload your documents

We need to verify your identity with clear photos of your MyKad (front and back).

3

You’re done!

Your FinDoctor report is ready. You can immediately know your chances of approvals from different banks.

Instant AI Loan Check

Know Your Loan Eligibility Without Affecting Your Credit Score

Lite Report

FREE

Basic

Start Free

Free report includes:

Summary of income profile

Basic loan eligibility insights

Pro Report

RM50.00

Monthly unlimited access

Recommended

Go Pro

Everything in Lite and...

Full AI Loan Eligibility Report

Instant Loan Pre-Approval (Mortgage)

AI Credit Score & Loan Eligibility Analysis

Credit Profile Matching to 20+ Banks

Pro Advisory

RM99.00

Monthly unlimited access

Best Value

NP: RM499

Save RM400.00!

Go Pro Advisory

Everything in Pro and..

AI-Driven Personalized Financial Advice

45 minutes 1-on-1 Coaching Session

Application & Interest Reduction Guidance

Smart AI Debt Consolidation

Plan Comparison

| Features | Lite Report | Pro Report | Pro Advisory |

|---|---|---|---|

| AI Loan Eligibility Check |  |  |  |

| Income Profile Summary |  |  |  |

| AI Credit Score & Loan Eligibility Analysis | — |  |  |

| Instant Loan Pre-Approval (20 Banks) | — |  |  |

| AI-Driven Personalized Financial Advice | — | — |  |

| 45-Minute 1-on-1 Coaching Session | — | — |  |

| Application & Interest Reduction Guidance | — | — |  |

| Smart AI Debt Consolidation | — | — |  |

Your credit score and report data are powered by CTOS and other reputable third-party sources.

People love FinDoc!

“Advisor provides details explanation. The programme is good in terms of helping borrowers in saving housing loan interest.”

Amelee Yeoh

“Help to clear my doubt on financial question and secure better

offer for my loan.”

Yih Lam Chew

“Clearly understand your own loan capacity, which bank can borrow

the lowest interest, and how to invest.”

Hui Mei Koh

Read more reviews on Google Review!

Read more reviews on Google Review!FinDoctor Money Tips

Find out all the latest news and exclusive guides about personal finance

More Articles >Introducing our trusted financial partners

Stay informed and stay ahead!

Subscribe to our newsletter for exclusive content, in-depth analysis, market trends and more!